The History of How I Got Here (Continued)

We developed SmartPath.ai from late 2017 to 2019. It evolved from our separate data systems into a single campaign platform. Machine learning (ML), not AI, was its foundation. We've used ML regression models to find patterns. We did this in anticipation of a shift to AI, and we branded them as such for marketing.

The platform addressed a significant pain point: the inefficient handoff of data and insights to clients whose systems couldn't maximize the potential for follow-up. SmartPath.ai was designed to handle everything, from connecting marketing channels and creating audiences to activating them and orchestrating entire campaigns.

The CTV industry was experiencing rapid growth. We've been testing CTV and OTT platforms. We developed TVTargeter as a sales tool to add TV to our marketing. We also rebuilt our HashTargetr pixel to work with SmartPath.ai. It doesn't use PII and has achieved amazing results.

Building SmartPath.ai with our funds was slow, so we sought investors. One prospect arranged a meeting with Mark Cuban in Dallas. In December 2019, we had a 2.5-hour meeting with him at a small Italian restaurant. Cuban, knowledgeable about data companies and marketing, provided invaluable feedback that altered our business trajectory.

While Cuban didn't invest, he offered a challenge: simplify SmartPath.ai. He wasn't interested in the complex data and functionality; he wanted a single screen demonstrating the cost of acquisition reduction. He believed this simplified version would have broad market appeal.

We took Cuban's advice to heart.

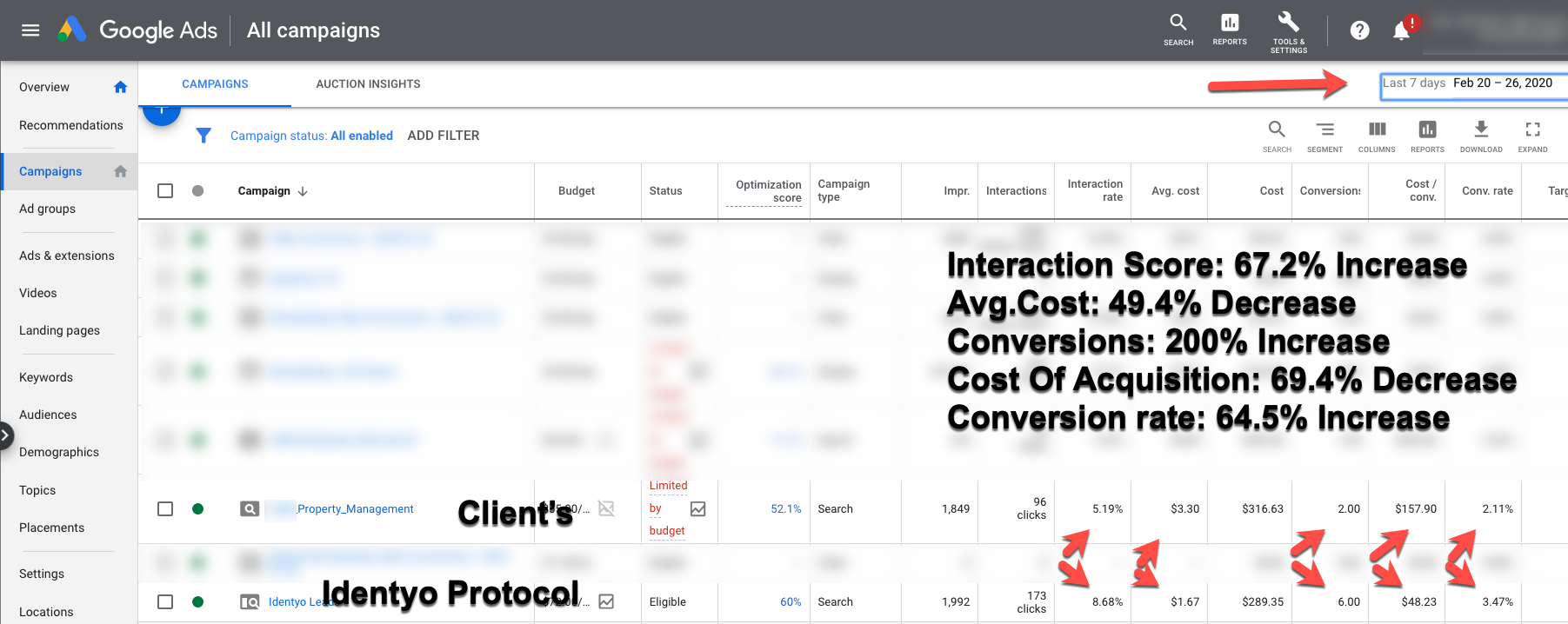

We rebuilt, refined, and rebranded SmartPath.ai in ninety days into IDENTYO.

Our prospective investor became our seed investor. By March 2020, we were ready to launch at the RampUp Conference in San Francisco. The positive reception confirmed IDENTYO's uniqueness, but the timing was unfortunate. As we were leaving San Francisco in early March 2020, COVID-19 lockdowns began, resulting in the slowest product launch I've ever experienced. Despite this setback, IDENTYO was off to the races.

IDENTYO was a game-changer. My pitch was simple. It would greatly cut costs for clicks, leads, and getting customers within 30 days. Try it. And it delivered every single time when it met certain criteria.

Like HashTargetr, IDENTYO was a single line of code, a pixel placed on a website. But the similarities ended there. We used zero PII yet could identify, score, and segment 95% of website visitors. The audiences were portable and compatible with all major ad platforms.

We offered a free 30-day trial, easily sparking interest. But, the ideal companies weren't easy to land. Our pixel needed a certain amount of data to work effectively—clients needed at least 30,000+ website visitors per month. This led to an interesting challenge: companies with that much traffic weren't keen on giving strangers access to their Google Analytics. Our pitch hit a snag when prospects learned they had to grant us access. Most granted access, but the big account took longer.

We had LendingTree as a client for a full year, but they wouldn't grant us access. We would guide their four-person analytics team through Zoom. We would show them how to set up audiences, attribution, and tracking. We would tell them not to change anything. When campaigns underperformed, they swore they hadn't touched anything. But, a Zoom call would reveal the changes and how to reverse them. This scenario played out with many large brands.

Our seed funding came with a caveat: no paid advertising until the loan/investment was repaid. This meant phone calls and social outreach. We signed up over a hundred agencies with existing client rosters—all done by yours truly, the one-man sales team. COVID-19 didn't exactly speed things up, but we still secured good accounts.

Before we landed LendingTree, one early mortgage client, spending $50,000 monthly on Facebook and Google Ads, doubled their leads in the first month using our pixel. Their AdOps guy was shocked and impressed. Around day 60, their CEO offered to acquire us for a seven-figure sum. Operating for just six months during a pandemic, it was too soon to exit. Instead, we offered to sell them an exclusive mortgage license for the same amount. They declined our counteroffer yet were profiting significantly from our tech, six figures monthly. This is when I realized our business model was flawed.

Our agency clients paid $500 monthly to resell the pixel and could offer unlimited free trials. After the trial, the pixel cost them $2 CPM, which they could resell at any price. That mortgage client, paying their agency $5,000 (10% of ad spend), generated us only $600 monthly while making a six-figure profit for the mortgage client. The math was clear: we needed to be on the lead/customer generation side of the equation.

My partners, who are more risk-averse, were happy when our revenue matched our burn rate by the end of 2020. By the end of 2021, we'd repaid our debt and could finally advertise. But by then, we'd all decided to pursue separate paths. My next path was the culmination of everything I learned; it was obvious.

What would you do?

Connect With Gil On Linkedin

ABOUT GIL ORTEGA

For over 30 years, Gil has earned the esteemed moniker of "The Chief Rainmaker" due to his renowned expertise as a Customer Acquisition Specialist.